If there’s one topic that’s dominated all of my client conversations (and any brand conversations, really) over the past two months, it’s the “T” word–tariff. Though so much attention has been paid to tariffs over the past few months, we’re no more certain how to adapt now than we were on April 2nd (so called “liberation day”). To recap:

Since that day, U.S. retail has been navigating a turbulent landscape from new tariffs on imports from China, Mexico, and Canada. Starting with a 10% universal tariff on basically all imported goods, then increasing tariffs on goods and materials specifically from China to as high as 145% before lowering *some* Chinese goods back down to 30% (note: if you’re looking for metal from China these materials are still at 145%). And now, we apparently have 90 days to figure something out before tariffs are likely to change again.

We’ve seen and heard the effects on both brands and consumers–Walmart announcing pricing hikes while Target, Adidas, and Best Buy are believed to be gearing up for similar adjustments. Price increases will no doubt lead to a pullback in spending, but what about brands that had decided 2025 was their year to enter retail? From those brands I get one question and one question only:

How much will it cost now to build my store?

Honestly, I could write a book–or a very very very long post about this. Because the answer is still: it depends.

But, as to not totally skirt this question, here are a few things I’ve learned over the past 8 weeks as we’ve bid (and re-bid, and re-re-bid) GCs, millworkers, signage vendors, and the like:

On aggregate, stores are costing ~30% more to build now than they were about 90 days ago. Of course, there are exceptions on both sides—and it is important to take into account your materials, the size of your store, where you are building (major city or tertiary market)—but in general this is what I’ve seen.

It’s hard (nearly impossible, really) to avoid having at least something come from China. Even if you choose a US fabrication, or work on getting fixtures, furniture and equipment from Mexico, Canada or Vietnam, at least some component or material has to come from China.

It’s not just materials that are seeing a cost impact, it’s labor too. Fabricating, or even simply assembling, in the US is more expensive and as a result of the shift to more domestic production, skilled carpenters are in higher demand. And as we all know, higher demand yields higher costs.

There are things brands can do to keep their costs down. Most fabricators are absorbing some of the tariff burden and want to keep working with brands on their buildouts–especialy if they’ve been in a long-term relationship.

GC costs are up, too. The raw materials for framing, drywall, carpentry, HVAC equipment, etc, are impacted by tariffs causing base buildouts to become more expensive as well. Higher material costs trickle into a higher overhead and profit line as GCs struggle to maintain margin.

Similar to fabricators, though, GCs want to continue to do business with brands and are willing to take a smaller profit especially if a brand is committing to multiple stores.

The rekon team is currently working with several of our brand clients to mitigate the impact of tariffs on current store buildouts through running competitive bid analysis and value engineering exercises. If you know any brands (or you are one) that could use this type of assistance, please reach out: hello@rekonretail.com

ICYMI…

I spoke with Kaleigh Moore at Forbes about a new agency matching influencers with brands to host irl events: Gen Z Wants Real-Life Experiences—This New Agency Helps Brands Deliver

When Halie LeSavage from Marie Claire reached out about tariff impacts on women-owned businesses (rekon is one btw) of course I had something to say: Trump's Tariff Chaos Forces Women-Led Brands to Strategize and Adapt—Fast

If you missed Placer.AI’s Women’s History Month feature, you can check it out here: Fierce & Female: Shaping the Future of Retail

The Return of the Retail Flagship

After more than 20 years in this retail game, much like fashion, I’ve learned that everything that’s old is new again–if you wait long enough. I’ve previously written a bit about the retail pop up phenomenon (perhaps more is coming…stay tuned) and I’ve been known to blame Warby Parker and its famous Class Trip for this idea that every brand has to first do a series of pop-ups before opening a “permanent” retail store. But recently, I’ve been seeing more and more brands skipping this short-term test in favor of long-term (that’s a 5+ year lease to most brands) flagship commitments–and I am here for it.

Why is this? Isn’t diving right into a flagship store unwise or reckless or both? What if the store fails and the brand is stuck in a long-term lease?

The above are good questions to ask and depending on where a brand is in its age and growth, the answer could be yes or no to any of these. For brands that have an established customer base and brand awareness, have sold irl through partnerships, shop-in-shops or wholesale, and have the capital, not wasting time and precious dollars on a smaller, shorter, more chaotic version of a retail environment could be the best strategy.

Since I spent the start of this newsletter discussing the rising cost of store buildouts, let me now make the case for the retail flagship–even with those added cost implications.

Build brand equity and long-term loyalty. The physical appearance of a branded, thoughtful retail environment raises both brand awareness and brand affinity for consumers. It’s difficult to run a customer engagement strategy on a temporary basis, but having a long-term location allows a brand to test events, partnerships, and personalization services. While some learnings about customer behavior can be gleaned from short-term activations, the real connection happens when a brand is able to interact with customers and build a long-term relationship.

Customers experience more operationally efficient environments. Oftentimes with pop-ups, brands have very little time to throw something together–design, fixtures, training, staffing, etc. And customers can tell. The very nature of a short-term activation is chaotic. But building a store that will be there for 5+ years allows brands to slow down, think through design, create SOPs, be selective about hiring, and create customer experience training. Each of these elements should be thought through for any retail environment, no matter the term, but in reality they often get skipped or haphazardly thrown together for a shorter-term store.

Penetrate the market and follow the data. Perhaps the most important difference between flagships and short-term retail is the depth and accuracy of the data that brands can gather. While a short-term activation will tell brands some things about customer purchasing behavior, traffic patterns, conversion rates, etc, a retail store that is open for less than 12 months really can’t tell you how that store will perform long-term. With flagship retail, you can detect patterns in seasonality, shifting demographics in the market, respond to customer demand and trends, and generally become faster and smarter at tweaking the experience, product mix and local marketing to achieve success.

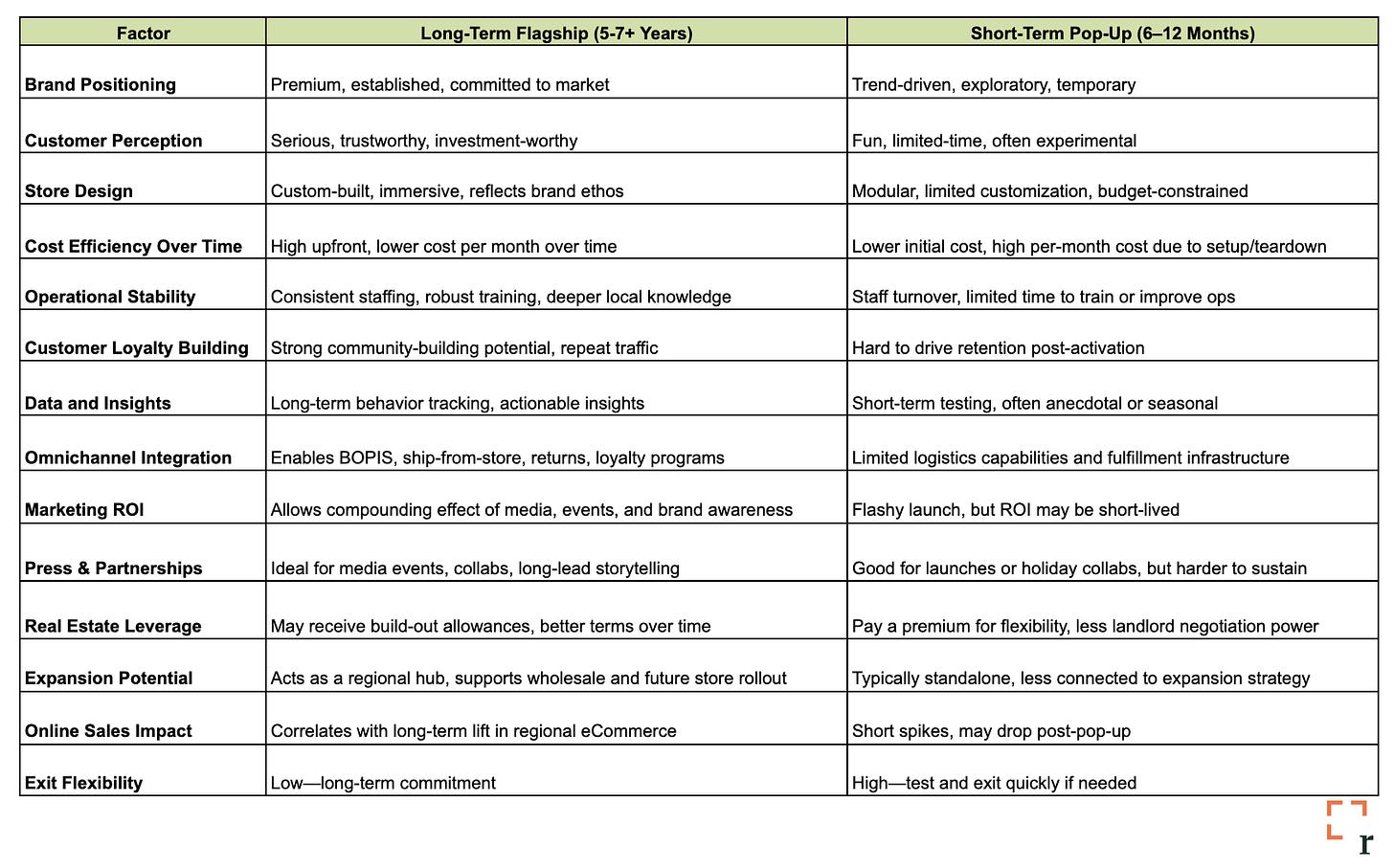

Of course, there are many more reasons why brands are opting for less pop ups and more permanent flagships so I’ve made a summary table with a few more comparisons so that this newsletter doesn’t become egregiously long…

Pop-ups are flashy—and they have their place—but they rarely build the kind of long-term brand equity that a flagship store can. A flagship is a statement. It's not just about selling product; it's about owning the narrative, controlling the experience, and anchoring your brand in a physical, permanent way. While pop-ups can generate short-term buzz, flagships create lasting value. They drive repeat traffic, deepen customer loyalty, and serve as a cultural home base. If you’re playing the long game, a flagship isn’t just worth it—it’s necessary.

Did you know:

While we most often work with brands as new store execution partners, rekon Retail recently started offering advisory and strategy services for brands that:

Are curious about what it would take to open a retail store.

Want to expand their current retail footprint but are uncertain where to start.

Would like to value engineer their current store buildouts.

Have a thought-partner that’s “been there, done that” in all facets of retail store openings.

If this is you (or if you’re ready to dive right in and need an execution partner), book some time: https://calendly.com/rekon-retail/20min